What to Know

- Personal lenders bring short-identity mortgages as an option to the big financial institutions.

- Private mortgage loans has actually large rates and you may costs, however, these include convenient and less getting recognized having.

- Individuals which may turn toward individual lenders include people who have crappy credit, individuals who believe international otherwise abnormal money sources, and you can beginners so you’re able to Canada as opposed to a position records.

- Essentially, personal mortgage loans can be used once the a temporary services when you improve your money.

What are individual mortgage brokers?

Personal lenders are individual providers and other people one give out their money. This can include Financial Funding Providers, in which funds from individual traders are pooled to pay for syndicated mortgages. Individual loan providers dont deal with deposits about social, as well as commonly federally or provincially regulated.

Personal mortgage loans are typically reduced and come with large rates of interest and you may costs compared to those provided by old-fashioned mortgage lenders. They are intended to be a short-term level prior to transitioning back in order to regular lenders.

Individual Mortgage lenders Across the Canada

Private mortgage lenders possess went on being an increasingly popular possibilities to possess residents as well as have was able an important role in the Canada’s property sector. Considering analysis about CMHC, non-bank lenders began $ mil property value mortgages in 2021.

If you’re near to 50 % of which were of borrowing from the bank unions, there are still 306,000 mortgage loans came from 2021 from the individual lenders, worthy of next to $100 mil. Which incorporated home loan boat loan companies (MFCs), mortgage resource agencies (MIEs), and trust businesses. There are many different lenders where you are able to score a private mortgage from.

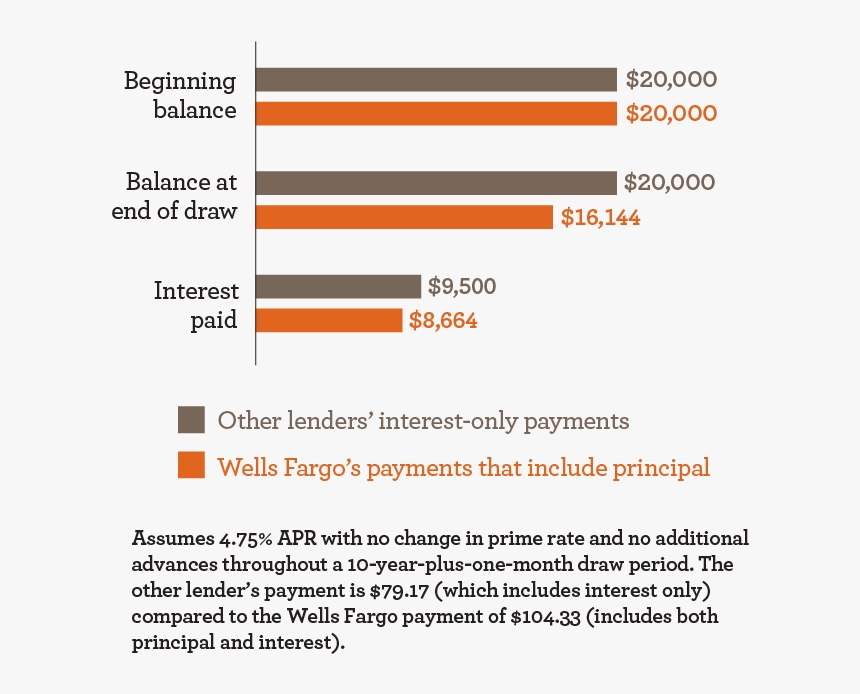

The latest desk less than lists a selection of individual lenders within the Canada and you can compares its personal financial costs, limit LTV ratio, whenever they allow focus-merely repayments, incase he’s zero lowest credit rating demands.

When you yourself have the lowest otherwise subprime credit rating lower than 600 , you will probably you need an exclusive lender. Lenders can use your credit rating to take on the economic health, that may lead to being qualified for home financing or perhaps not. Not shed any repayments, with the lowest borrowing use rates, holding a minimal (otherwise zero) balance towards credit cards, and having a lengthy credit rating have a tendency to alter your credit history.

At least credit score off 600 will become necessary to have CMHC mortgage insurance rates. Because so many B Lenders handle covered mortgages, not being able to be eligible for a great CMHC insured financial will prohibit you from of several B Lenders. Loan providers can also require that you obtain financial insurance coverage even in the event you create a downpayment larger than 20%.

How can i check my credit rating?

The two credit reporting agencies during the Canada is Equifax and you will TransUnion. You could demand your credit rating and you can credit file from all of these enterprises by post or on the internet for free. Nevertheless they promote extra products and services to own a charge, for example credit overseeing.

Equifax and you may TransUnion only declaration information in this Canada, as they are employed in of a lot countries for instance the United states. Your credit report exterior Canada might not be acknowledged according to debt place. Beginners and the immigrants so you can Canada might have dilemmas qualifying to possess home financing whether they have a limited Canadian credit rating.

That will personal lenders help?

Individual lenders assist complete new gap remaining of the old-fashioned lenders. Individuals with a restricted Canadian credit history, particularly this new immigrants, get deal with a lot more difficulties when trying to obtain home loan approval off banking institutions. Lenders may also be helpful people who have troubles providing recognized for home financing. Other masters can be found on the the page on mortgage brokers against https://clickcashadvance.com/loans/loans-for-400-credit-score/ finance companies. At the same time, private loan providers will help the following individuals.

Tin Cậy Việt Công ty TNHH Tin Cậy Việt

Tin Cậy Việt Công ty TNHH Tin Cậy Việt