Government institution-supported loan programs are fantastic options for very first-date homebuyers otherwise straight down-earnings individuals. USDA and you may FHA financing is actually each other work with from the some other regulators organizations and will feel easier to be eligible for than many other conventional home loan software.

When you compare USDA and FHA financing, a person is not really much better than additional; the loan system that’s true to you varies according to their most recent disease. Both USDA and you will FHA mortgage loan loans provide numerous distinctions one to make sure they are popular with first-date homebuyers and reduced- in order to reasonable-money consumers.

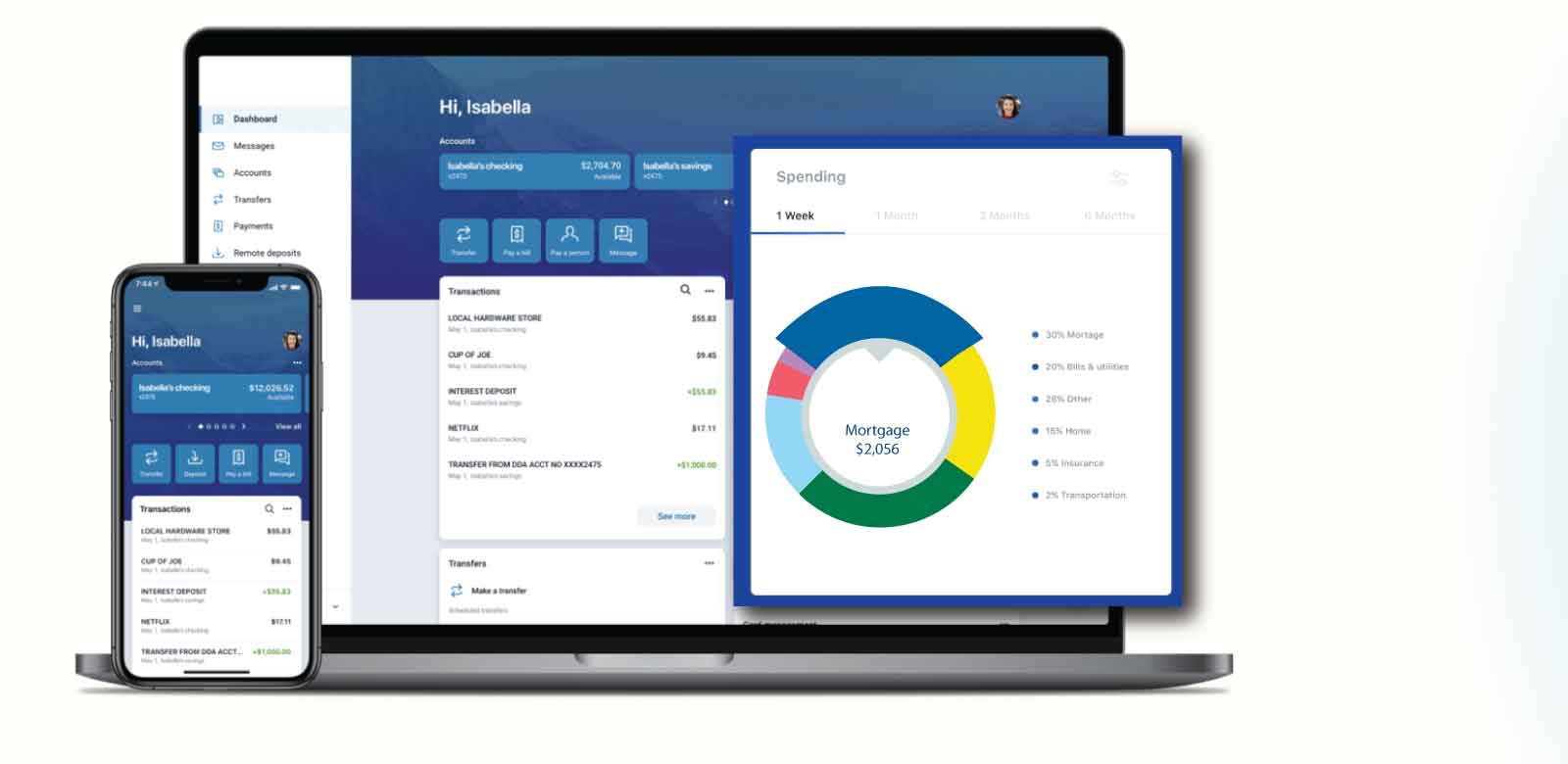

Once the the leading Kansas City mortgage lender, Basic Fidelis renders the newest lending process simple for you. All of our USDA and FHA finance are designed to generate real estate and refinancing significantly more affordable. Here is what you need to know on the FHA and USDA fund for the Kansas Town.

What exactly is a beneficial USDA Mortgage?

USDA funds are supplied from the personal loan providers and you will supported by the new You.S. Department off Farming. Having USDA funds, consumers have to meet certain income and you can area conditions mainly because loans are just accessible to those people located in qualifying rural communities.

As process of providing an excellent USDA loan may take offered than just a keen FHA home loan, it’s only because USDA fund must be underwritten double. Generally, the lender commonly underwrite the borrowed funds very first, and it might be underwritten once more by USDA. not, when you have a credit rating regarding 640 or higher, Blue Hills loans the loan is actually immediately underwritten from the USDA versus more time inside it.

Benefits of an excellent USDA Loan

USDA house lenders can perhaps work to you to get the finest financing system to suit your book disease. A beneficial USDA loan has the benefit of lots of benefits to help you home buyers, including:

- No down payment specifications

- Reduced financial insurance and you can fees

- The vendor can pay any settlement costs

- Usually less expensive than an FHA financing, one another initial and you will future

- Lenders might not require that you features bucks supplies to safe one financing solutions

- Zero credit limit; restriction amount borrowed relies on your capability to settle

USDA Financing Eligibility Standards

USDA mortgage loans are meant to raise homeownership prices additionally the economies when you look at the outlying parts. For this reason, you should reside in an experienced outlying town to take virtue away from a good USDA financing. Your location must meet specific county property qualifications conditions.

USDA loans has actually other qualifications requirements too. Your credit rating should be about 640 or more, and you also need to have a pretty low debt-to-earnings ratio-as much as 50 percent of your own earnings otherwise faster.

Eventually, USDA funds has rigid money peak rules. These may will vary with regards to the number of people on the family together with located area of the household. In the event the earnings is over 115 percent of your average earnings in this urban area, you will be ineligible and cannot be eligible for an excellent USDA loan.

What’s a keen FHA Loan?

A keen FHA mortgage is backed by the latest Government Homes Administration and you may given by way of personal lenders. If you’re an enthusiastic FHA financing process usually takes more time than an excellent USDA financing, it’s plenty of self-reliance having home buyers having straight down credit scores.

But not, FHA home loan conditions carry out specify a max financing count founded on the location, so it is vital that you keep this in mind as you shop having residential property.

Benefits associated with a keen FHA Loan

- Demands a credit history of 580 or higher, so it’s an excellent option for people who have straight down borrowing from the bank

- No money standards otherwise limits

- Large personal debt-to-earnings proportion anticipate

FHA Loan Eligibility Standards

Merely earliest-date homebuyers are recognized getting a keen FHA loan. In addition, it boasts individuals which have not had property from inside the within minimum three years.

While you are there aren’t any earnings standards getting FHA funds, you will have to establish your earnings count and show you to definitely you can make month-to-month home loan and you may insurance policies costs. FHA fund together with allow for increased debt-to-money ratio, particularly if you features a high credit score.

While you are a primary-date home buyer or trying refinance, Earliest Fidelis will be here to greatly help. We provide all of our people USDA and you can FHA financing options, thus all of our professional loan providers will find best mortgage system having your. Start out with all of our pre-acceptance app, or contact us today on 913-205-9978.

Tin Cậy Việt Công ty TNHH Tin Cậy Việt

Tin Cậy Việt Công ty TNHH Tin Cậy Việt