Trying to find and purchasing your perfect family inside Melbourne are a keen fun but tricky techniques. And come up with your residence purchasing trip simpler plus successful, consider bringing pre-approved to possess a home loan. Pre-accepted home loans during the Melbourne render numerous experts that will provide you an aggressive edge on the housing market.

On this page, we’re going to explore as to why acquiring good pre-accepted home loan is a good idea getting Melbourne homebuyers

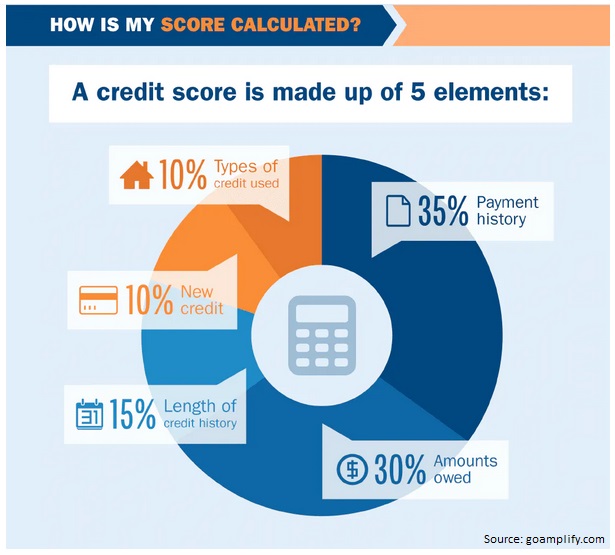

- Clear Finances and you may Economic Depend on: Taking pre-accepted getting a mortgage provides you with a definite facts of the funds and borrowing capability. By going through the pre-approval processes, loan providers determine your debts, as well as your earnings, credit score, and personal debt-to-money ratio. With a pre-accepted amount borrowed at hand, you could Tennessee title loans TN potentially with confidence search for property within your budget diversity, getting rid of the newest suspicion out of if you’ll be eligible for that loan later.

On this page, we will discuss as to why acquiring good pre-recognized mortgage is actually a good idea to have Melbourne homeowners

- Improved Negotiating Strength: Which have an excellent pre-approved home loan will provide you with a plus when discussing that have providers for the Melbourne’s competitive market. Sellers have a tendency to choose handling people that currently shielded funding whilst helps to control prospective financing things derailing brand new sales. Because of the to provide a beneficial pre-acceptance page, your prove that you is actually a serious and you will well-waiting client, that can boost your standing during the deals.

On this page, we’re going to discuss as to the reasons getting a pre-approved mortgage is a wise decision for Melbourne homeowners

- Smaller Loan Control and Closing: As the pre-approval procedure comes to submitting very important financial files upfront, they streamlines the borrowed funds running and you can closure amounts. With good pre-recognized mortgage, the financial institution has verified your financial suggestions, enabling a quicker loan acceptance when you find a home. This can slow down the total time and energy to intimate the offer, providing an aggressive boundary over almost every other buyers who possess not yet , obtained pre-acceptance.

On this page, we shall mention why getting a great pre-recognized home loan is actually a good clear idea to own Melbourne homebuyers

- Peace of mind and focus: A pre-accepted home loan gives you assurance from inside the house to find process within the Melbourne. You could potentially with full confidence generate has the benefit of toward home understanding that the investment is actually put. Which clearness enables you to focus on finding the best possessions and you can and also make advised ount. Comprehending that you have got already pulled the necessary steps in order to secure financing, you might method the home to shop for processes confidently and less be concerned.

In this article, we are going to mention as to the reasons acquiring a beneficial pre-acknowledged mortgage try a good notion to own Melbourne homebuyers

- Self-reliance and Rate Safety: Acquiring an excellent pre-recognized financial hair during the mortgage loan to have a specific months, securing you against possible rate of interest fluctuations. This allows one to plan your allowance far more correctly and avoid one offending unexpected situations if the rates of interest rise. At the same time, when the rates drop off inside the pre-recognition period, specific lenders may offer you the down speed, delivering further self-reliance and you can prospective discount.Protecting good pre-approved home loan in Melbourne is actually an important step-in the fresh home buying procedure. Having a clear budget, improved discussing strength, reduced financing handling, comfort, and you will rates cover, pre-accepted lenders render multiple advantages for Melbourne homebuyers. By using this call to action, you can with confidence realize your perfect house, knowing that you’ve got the financial support and then make a strong bring and you will intimate the deal effortlessly.

Using foundation of homeownership can be a little scary. However,, did you know that providing pre-recognized having a home loan can make your home-to invest in processes super easy?

Preapproved lenders give you a selection of experts, you start with making the techniques as easy and you will simple as it is possible to.

Into the brief, be aware that by getting preapproved, you won’t just solution an essential financial make sure that commonly meet the requirements you to receive our home mortgage you are entitled to, however you will be also self assured on the power to safer financing regarding loan, deciding to make the real estate procedure as facile as it is possible.

What’s good preapproved financial? A great pre-approved home loan was, within the simple conditions, an initial loan approval process that allows potential individuals to-be told off a crude imagine of the credit count in advance of and come up with people purchases.

Who can submit an application for pre-approved lenders? Quite often, candidates should have a good credit score, secure income, and enough offers, one of almost every other monetary official certification.

Your Fast Pay back Financial Money Mentor often complete you inside the for the information after

*Their Punctual Pay off Financial Money Advisor usually opinion your certificates and give you the best choices that suit your financial allowance and requires.*

Tip: when you are interested in to invest in a house, work with providing its money to make sure that your own mortgage to improve likelihood of acceptance.

Are there positive points to pre-approved lenders? The advantages of pre-accepted lenders are numerous, and you may consumers is also power all of them to have a softer, easy techniques: A beneficial pre-recognized mortgage traces an authentic cover consumers in their family pick Simplifies the home-to buy processes Has individuals one-step ahead of the housing industry

Exactly what are the standards to have pre-acceptance? A home loan application, proof the potential borrower’s possessions, earnings and a career verification, and you can good credit are area of the requirements that a debtor will be present. Get off the others so you’re able to us. Your own Fast Pay-off Home loan Finance Coach allows you to choose of various lenders that suit your credit rating and you may financial predicament.

Why does the process go? After evaluating their mortgage software, Quick Pay back Home loan will choose whether or not to pre-accept the loan otherwise pre-approve it that have requirements (that have requirements becoming in order to often make you provide extra documentation otherwise have it smaller and control your present personal debt to possess lending direction). We will provide chances to boost the likelihood of your pre-recognition if you refuse to get accepted.

Whenever Do i need to Rating Pre-Approved for a mortgage? It is usually better to rating pre-acknowledged to possess a home loan prior to starting family bing search. That way, it will be far easier on how to discover your own limitation loan recognition count and people barriers that may impede the application, as well as way too much obligations or otherwise not-so-good credit scores.

People possess an effective gazillion questions when they get going to the their house-to invest in excursion. This is where your own Prompt Pay back Home loan Funds Mentor usually let. When you yourself have questions in regards to the route you need to simply take and the financial which is best suited for your requirements, please call us to safer the next. The audience is here to help you succeed every step of your means.

Tin Cậy Việt Công ty TNHH Tin Cậy Việt

Tin Cậy Việt Công ty TNHH Tin Cậy Việt