A cash receipts journal is a subsidiary ledger in which cash sales are recorded. This journal is used to offload transaction volume from the general ledger, where it might otherwise clutter up the general ledger. The cash receipts journal is most commonly found in manual accounting systems. The concept is essentially invisible in many accounting software packages. Record your cash sales in your sales journal as a credit and in your cash receipts journal as a debit.

Single Column Cash Book

- The cash ledger book can act as both a journal and a ledger and comes in various formats.

- For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

- All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

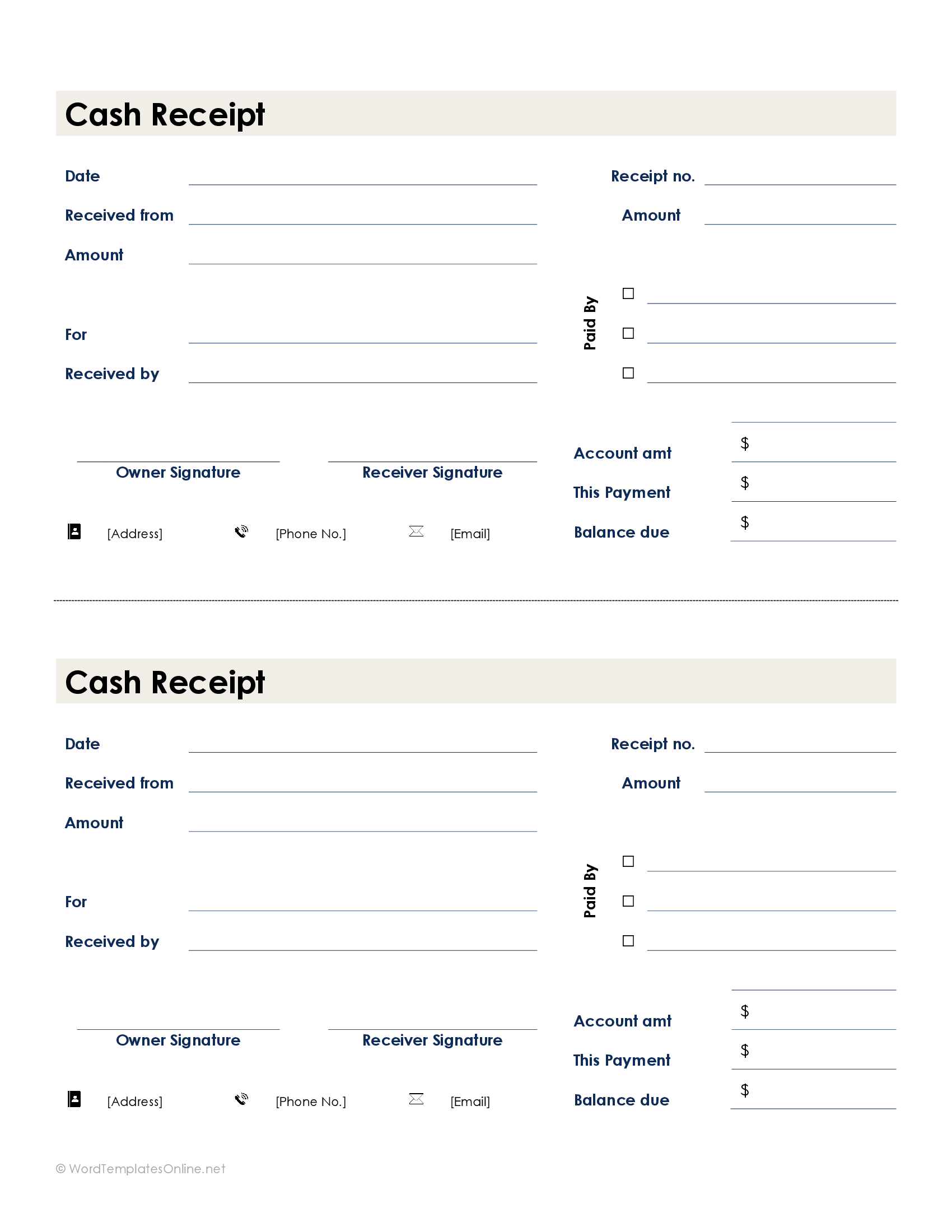

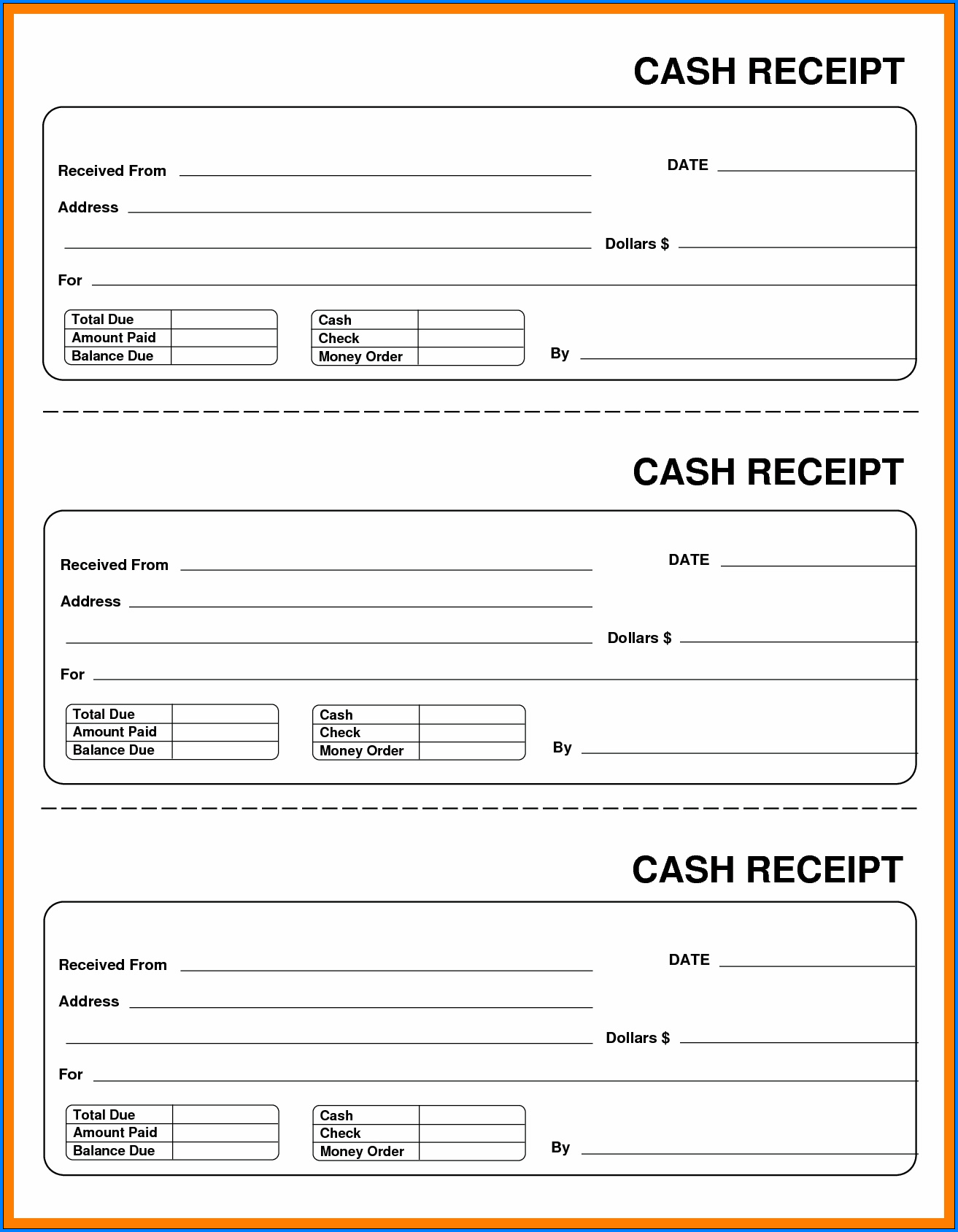

A cash receipts journal is used to record all cash receipts of the business. Your cash receipts journal should have a chronological record of your cash transactions. Using your sales receipts, record each cash transaction in your cash receipts journal. You calculate your cash receipts journal by totalling up your cash receipts from your accounts receivable account.

What is the Cash Payment Journal? Example, Journal Entries, and Explained

In fact, you have a few customers who come in several times a week to buy books or toys from your store. You allow those customers to keep a running tab, and they pay you once a month. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. partnership All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

Accounting Ratios

This way an accountant or bookkeeper can analyze the amount of cash collected and recorded during a period separate from all other journal entries in the general journal. Again, the three column cash ledger diagram below shows only one side of the cashbook, in this case the left hand receipts side (debit). The two column cash ledger book is sometimes referred to as the double column cash book or the 2 column cash book. Again, for simplicity, the two column cashbook ledger diagram below shows only one side of the cashbook, in this case the left hand receipts side (debit). Again, for simplicity, the two column cashbook ledger diagram below shows only one side of the cashbook, in this case the left hand receipts side (debit) .

This is necessary because there are numerous transactions that lead to the receipt of cash. Additionally, accessing monetary information through a cash receipts journal is far quicker than tracking the cash payment through a ledger. Manual accounting systems will likely use special journals for recording routine transactions. Accounting principles help govern the world of accounting according to general rules and guidelines. To log these transactions in a cash receipts journal, each of these transactions is entered sequentially into the journal in the appropriate column. The cash book is updated from original accounting source documents, and is therefore a book of prime entry and as such, can be classified as a special journal.

The cash receipts journal is used to track transactions where a shop or wholesaler sells products to a customer and receives payment in cash. Whenever a company receives cash for any reason, the journal entry is recorded in the cash receipts journal. Other sources of cash often include banks, interest received from investments, and sales of non-inventory assets. When a business gets a loan from a bank, the transaction to record the loan is made in the cash collections journal. Credit sales and sales made on account are not usually recorded in this journal because there isn’t any cash collected in these transactions.

When a company receives a loan from a bank, a transaction is performed in the cash sales collections journal to record the loan. The main objective of a cash receipts journal is to properly manage cash by making it simple to ascertain cash balances at any given time, enabling managers and corporate accountants to budget their cash. Regularly, an overall sum of the journal balance is calculated and sent to the general ledger. When looking into a specific cash receipt, a person would start with the general ledger before descending to the cash receipts log, where they might find a reference to the particular receipt. Depending on the nature of the business involved the two columns can be used for different purposes.

A cash receipts journal is a special journal within the general journal that is used specifically to record all the cash receipts. It has a total record of all the cash collections during an accounting period. When a retailer sells merchandise to a customer and it collects cash, this transaction is recorded in the cash receipts journal.

Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Tin Cậy Việt Công ty TNHH Tin Cậy Việt

Tin Cậy Việt Công ty TNHH Tin Cậy Việt