This way, you can keep the selling price more reasonable while still paying off your commercial loan. In investing, the break even for a stock or future trade is estimated by comparing the market price of an asset to its original cost. Investors reach the breaking point when the original cost and the market price of the asset are the same. When the market price increases, that’s when investors earn profit. As with most business calculations, it’s quite common that different people have different needs.

When to use break-even analysis

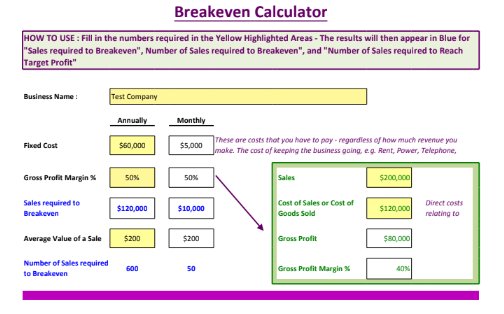

To determine the break even point (BEP), you must take the total fixed costs of production, and divide it by each individual revenue minus the variable cost per unit. Again, fixed costs are expenses that do not change based on the number of units sold. Assume a company has $1 million in fixed costs and a gross margin of 37%. In this breakeven point example, the company must generate $2.7 million in revenue to cover its fixed and variable costs. If you don’t reach the BPE within the desired timeframe, you’re in danger of incurring losses. To reduce BPE and recoup expenses sooner, it helps to cut costs on fixed and variable expenses.

Assumes constant selling prices

But in certain situations, such as social distancing measures due to the COVID-19 crisis, traveling may be discouraged. Unless you need to transport certain goods, you might not have to do a lot of driving or traveling. Meeting clients may be a matter of taking a video conference call. If you’re starting a new company, consider hiring staff on a freelance, part-time, or project basis.

Credit & Debit

- The loan term depends on the type of loan and how you intend to use the money.

- Some stocks are rather immune to inflationary pressure, while others can even benefit from inflation.

- SBA loans offer some of the lowest business loan rates in the market and long payment terms.

- The break-even point is calculated by dividing your fixed costs by the difference between the sales price per unit and the variable cost per unit.

- When this happens, expect your BEP to increase because of the higher expenses.

Thus, companies can only earn when their total revenue surpasses the break even point. That is why BEP is also referred to as the time it takes for how to calculate ending inventory under specific identification a business to become profitable. On the other hand, if you keep earning lesser revenue than your estimated costs, your business will face losses.

Loan Calculators

Instead of just ads, holding these events will help people remember your brand on a positive light. Ads and marketing can take a considerable chunk from your revenue. Thus, make sure your campaigns all generate awareness and send the right message to your target market.

What Types of Financing Do Businesses Rely On?

Often, new business owners do not get the results they need by simply putting ads. Remember that marketing is a process that entails planning and reaching goals. The usual ad strategies won’t necessarily bring more clients or sales to your business. Besides ads and social media posts, here are several effective marketing practices that help increase sales.

When analyzing your break-even point, not only do you want to see that your business is breaking even, you’re looking to make sure your business is profitable as well. Here are a few ways to lower your break-even point and increase your profit margin. Consider the following example in which an investor pays a $10 premium for a stock call option, and the strike price is $100. The breakeven point would equal the $10 premium plus the $100 strike price, or $110.

When it comes to securing investors, especially starting out, they want to see that you’ve done your homework and understand how your business will make money. It shows potential investors how much you need to sell to cover your costs and when they can expect to see returns on their investment. The break-even point (BEP) is the point at which the costs of running your business equals the amount of revenue generated by your business in a specified period of time. In other words, your company is neither making money nor losing it. Thus, if a project costs $1 million to undertake, it would need to generate $1 million in net profits before it breaks even.

Generally, to calculate the breakeven point in business, fixed costs are divided by the gross profit margin. This produces a dollar figure that a company needs to break even. Break-even analysis assumes that the fixed and variable costs remain constant over time. However, costs may change due to factors such as inflation, changes in technology, and changes in market conditions. It also assumes that there is a linear relationship between costs and production.

If your landlord won’t adjust your rent, consider looking for a more affordable space for your business. But as social distancing measures loosen, some companies do consider work space. If you’re not a big firm, you won’t need a space with a conference hall. Things like that can be rented by the hour when you hold an event. It’s also more cost-effective to share restrooms and dining areas with neighboring offices when you’re looking for a professional space.

Tin Cậy Việt Công ty TNHH Tin Cậy Việt

Tin Cậy Việt Công ty TNHH Tin Cậy Việt