This new Mexico Financial Loans Authority (MFA) have two home loan apps to simply help The newest Mexico very first-time homebuyers that have reduced or moderate revenue.

You have to be in just one of these types of condition-work with mortgage applications if you would like gain benefit from the MFA’s advance payment guidelines applications.

MFA FirstHOME Mortgage System

Which basic-big date client system brings an FHA, Va, USDA, otherwise a keen HFA Well-known traditional mortgage. It can be used combined with This new Mexico’s downpayment assistance program.

Borrowers must have a credit history with a minimum of 620 and you will put down at the least $five-hundred. If the a purchaser does not have any a credit score, alternative borrowing from the bank certification can be appropriate.

Unless the customer plans to pick property into the a specific area, discover money and buy rate limitations. Belongings from inside the structured equipment developments, townhomes, condos, single-household members detached homes, and some are created house all are qualified to receive financial support.

MFA NextHOME Financing System

Everyone who fits the requirements to possess an excellent NextHOME Mortgage can get pertain. not, first-big date consumers which have lowest and reasonable earnings . That’s because it sets a primary another home loan to assistance with a downpayment. The same as FirstHOME, borrowers need a credit history of at least 620 and contribute no less than $five hundred for the the purchase.

You to definitely difference is the fact that purchase price and you will earnings constraints are exactly the same for everyone borrowers, no matter what its venue or how many some one live in its household.

You can find money constraints into amount you can generate one are very different by program, condition, and home proportions. Observe the newest median earnings restriction one applies to your, down load MFA’s FirstHome System reality layer (from inside the English or Spanish) or even the HomeNow you to, together with inside English and Spanish. You will additionally get a hold of details of house cost limitations in those online payday loans Louisiane.

- Has actually a credit history off 620 or even more (while the MFA will get believe solution indicators away from creditworthiness during the unique circumstances)

- Favor a loan provider of a list of playing loan providers

- Complete a house buyer training movement

- Be able to inform you no less than 2 yrs away from regular a position

- Get manager check if your a job situation are stable

- Keeps a reasonable debt-to-money proportion

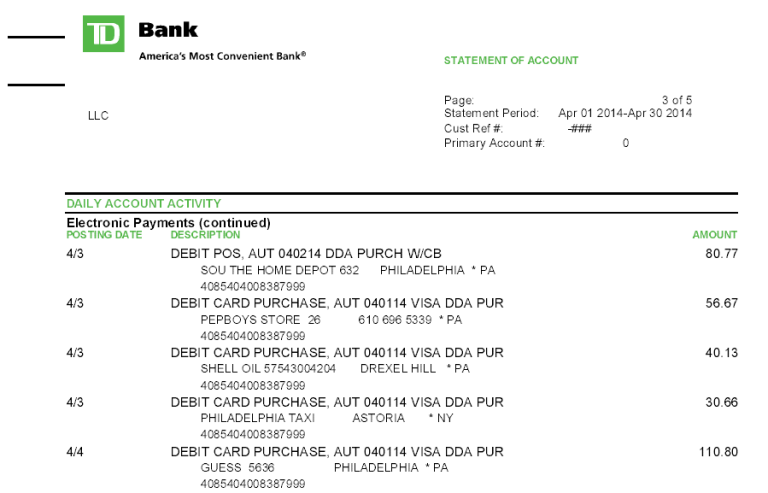

- Bring documentation revealing your debts

Much of people is actually something most of the lending company would need. However the credit rating tolerance exceeds you’ll need for an enthusiastic FHA loan.

Brand new Mexico Home loan Funds Expert DPAs are created to make homeownership significantly more available and sensible getting first-big date home buyers in the The fresh Mexico. They’re a valuable capital of these looking for assistance with the brand new initial will cost you of shopping for a home.

MFA FIRSTDown DPA

MFA will not usually offer has to help you The newest Mexico very first-date home buyers. However,, lower than their FirstDown program, it does provide the next ideal thing: forgivable fund.

These types of silent second mortgage loans do not have monthly obligations, charge 0% focus, and you can come with zero minimal loan amount. And, if you individual and you can inhabit the house (in place of refinancing) to possess 10 years, the mortgage try forgiven. However,, for people who sell, flow, otherwise refinance through to the avoid of your own ten th 12 months, you will need to pay back the entire sum you owe.

You should contribute $500 of your money into buy deal. Nevertheless nation’s loan may, possibly, shelter the remainder. Because you can acquire to 8% of 2nd home’s purchase price, capped within $8,000.

Also the statewide let provided by MFA, a talented real estate professional should know regardless of if any household visitors guidelines apps can be found in their target areas.

Tin Cậy Việt Công ty TNHH Tin Cậy Việt

Tin Cậy Việt Công ty TNHH Tin Cậy Việt