The needs and eligibility to have USDA home improvement funds try mostly similar to for other USDA-backed mortgages. However, you will find some extra limitations book to your treatment program you to borrowers should follow.

https://elitecashadvance.com/installment-loans-fl/windsor/

That is Eligible for an effective USDA Recovery Financing?

USDA debtor eligibility criteria are mainly concerned about guaranteeing applicants can manage their mortgage, can certainly make uniform on-big date costs, and you may match during the USDA’s mission in order to suffice lower- so you’re able to moderate-money homeowners.

Credit history

The latest USDA does not set a credit score minimal because of its outlying invention mortgage program. Instead, lenders are given the latest versatility to evaluate financing yourself and you may introduce her appropriate credit rating conditions.

USDA lenders will find a credit rating with a minimum of 640. But not, of several loan providers are prepared to deal with down ratings actually towards 500s.

Debt-to-Earnings Proportion

USDA loans essentially require you to purchase just about 34% of the gross income for the full home percentage as well as dominant, focus, fees, insurance policies, and HOA expenses. Their full DTI together with all other financial obligation money is going to be upwards to help you 41% otherwise 49% which have compensating items.

Domestic Earnings Constraints

For some parts, the latest 2024 earnings maximum to own a household out-of five is actually $112,450 together with the people in your family plus the individuals instead of the borrowed funds. Which restriction develops in high-pricing components. The latest USDA’s income limits record will teach the modern maximums having your area.

Exactly what Functions Are eligible?

Functions need to be found in this a prescription outlying city as qualified to receive good USDA financial including the USDA do-it-yourself financing program. Which designation is generally simply for organizations with fewer than 35,000 customers. You need to use the latest USDA qualification map to choose in the event that an effective household you’re thinking about qualifies having an agency-backed home loan.

Simply unmarried-friends residences qualify getting USDA-supported loans. You simply cannot purchase a beneficial multifamily household, though attributes which have an equipment house unit (ADU) could be appropriate if the ADU is not familiar with generate leasing earnings.

You ought to plan to are now living in your house as your pri to acquire vacation possessions such a pond family or hill cabin, nor do you require it to own funding objectives.

More Requirements to possess Rehab Financing

The property you are remodeling should have become created and acknowledged to own occupancy at least one year in advance of closure. You can’t fool around with an excellent USDA rehab financing into the new or partial framework belongings.

Builders and you can general contractors need to have at least 2 yrs out of knowledge of all facets from do it yourself you’ll need for the task.

The individuals carrying it out might also want to feel appropriately licensed in common which have local statutes and you will hold commercial general responsibility insurance rates with at the minimum $five-hundred,000 out-of visibility.

The home need certainly to already getting classified once the just one-family quarters. You simply cannot explore a beneficial USDA home improvement loan to convert an alternate build eg a great barn otherwise rural schoolhouse for the a personal quarters.

What sort of Renovations Might you Would?

You can use a good USDA rehabilitation loan to get a property making all sorts of home improvements and you may advancements. Some of the most common mortgage uses were:

Ineligible House Repairs

The fresh USDA really does exclude new re also away from getting used and make particular fixes and you will advancements. A few of the ineligible family variations are:

How do Qualified Solutions Compare with Other Do it yourself Loans?

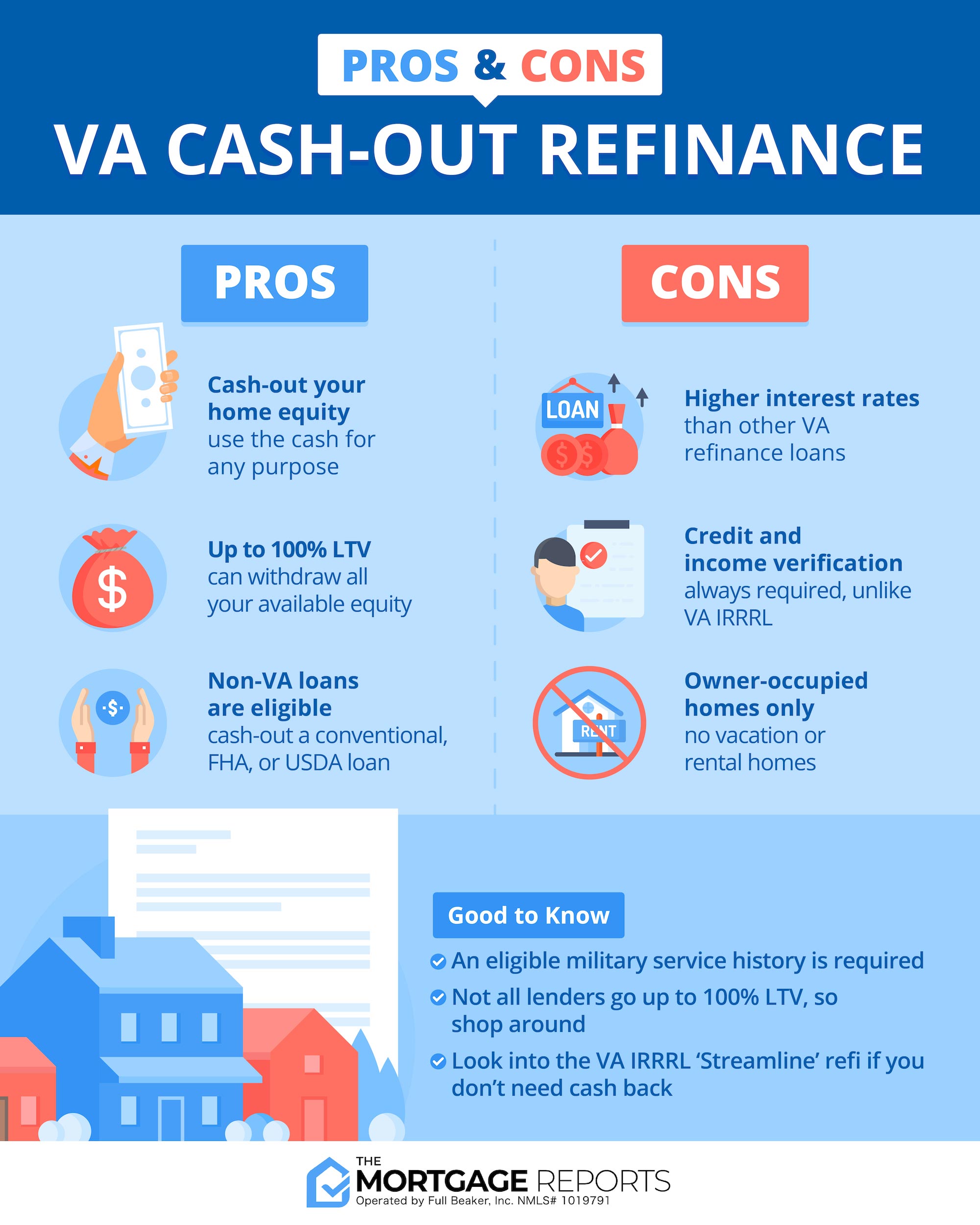

The USDA isn’t the just re available to homeowners. Individuals can also buy and you can rehab a house that have old-fashioned, FHA, and you will Va mortgage loans. Just how do these programs’ allowances and you can restrictions compare to brand new USDA renovation loan?

Va Restoration Financing: Developments are often much more minimal to the Virtual assistant as compared to USDA. Virtual assistant guidance accommodate small renovations, which will be complete in this 120 days of closing. You simply cannot have fun with a beneficial Va recovery loan and also make high structural changes otherwise advancements.

Tin Cậy Việt Công ty TNHH Tin Cậy Việt

Tin Cậy Việt Công ty TNHH Tin Cậy Việt