For example, in some industries, like technology, companies may maintain lower Current Ratios as their assets are less liquid but still maintain financial health. But, during recessions, they flock to companies with high current ratios because they have current assets that can help weather downturns. During times of economic growth, investors prefer lean companies with low current ratios and ask for dividends from companies with high current ratios. For example, if a company’s current assets are $80,000 and its current liabilities are $64,000, its current ratio is 125%. The current ratio expressed as a percentage is arrived at by showing the current assets of a company as a percentage of its current liabilities.

The need for contextual analysis

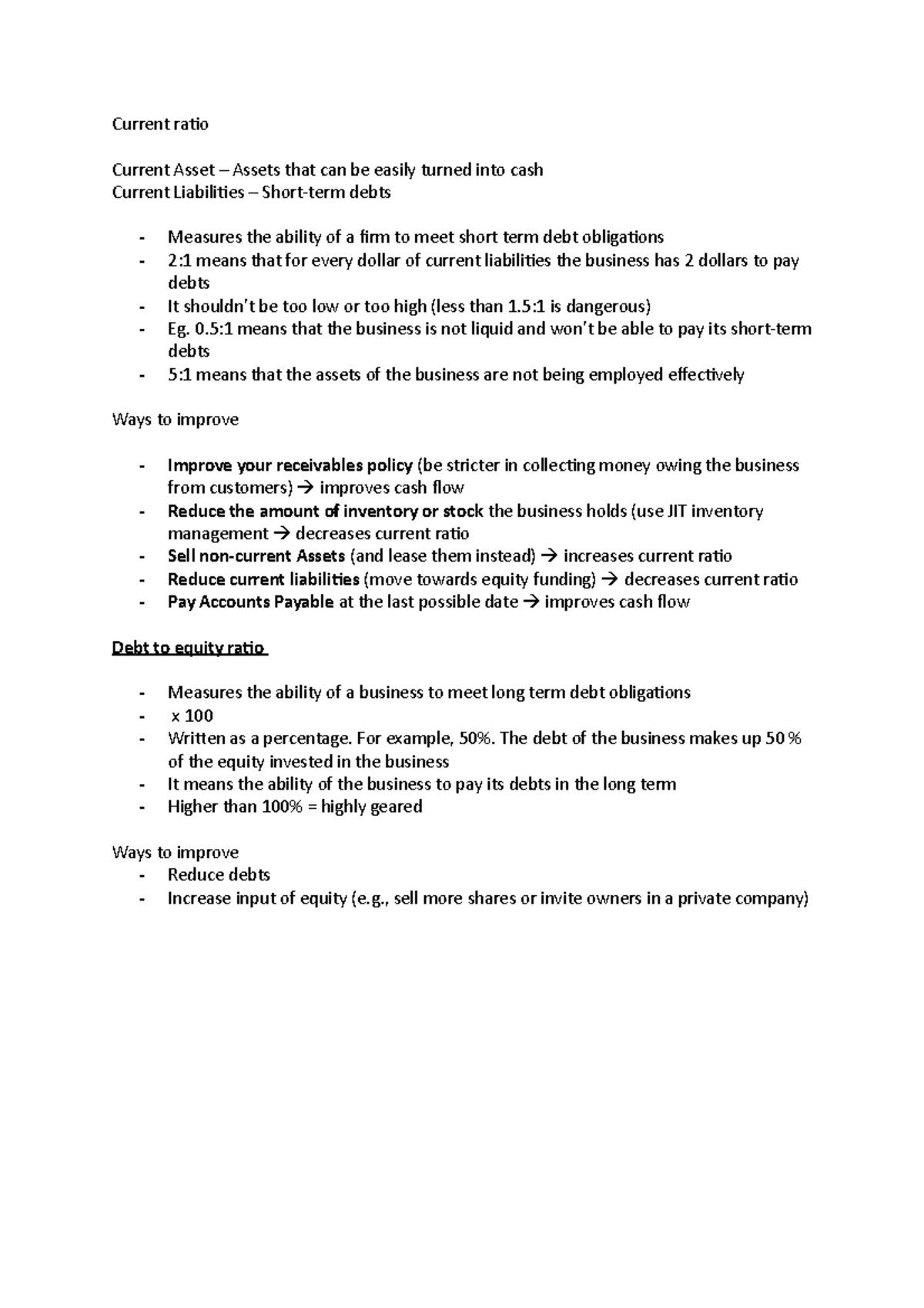

When determining a company’s solvency 一 the ability to pay its short-term obligations using its current assets 一 you can use several accounting ratios. The current ratio is a measure used to evaluate the overall financial health of a company. In other words, the current ratio is a good indicator of your company’s ability to cover all of your pressing debt obligations with the cash and short-term assets you have on hand.

Balance Sheet Assumptions

In such cases, acid-test ratios are used because they subtract inventory from asset calculations to calculate immediate liquidity. Current liabilities include accounts payable, wages, accrued expenses, accrued interest and short-term debt. The first way to express the current ratio is to express it as a proportion (i.e., current liabilities to current assets).

Ask Any Financial Question

Some industries for example retail, have typically very high current ratios while others, such as service firms, have relatively low current ratios. As the assets and liabilities are listed in the descending order of liquidity, current assets would appear above non-current assets. The current ratio of 1.0x is right on the cusp of an acceptable value, since if the ratio dips below 1.0x, that means the company’s current assets cannot cover its current liabilities. The formula to calculate the current ratio divides a company’s current assets by its current liabilities.

To calculate the current ratio, divide the company’s current assets by its current liabilities. Current assets are those that can be converted into cash within one year, while current liabilities are obligations expected to be paid within one year. Examples of current assets include cash, inventory, and accounts receivable. Examples of current liabilities include accounts payable, wages payable, and the current portion of any scheduled interest or principal payments.

How do you calculate the current ratio?

A higher current ratio is always more favorable than a lower current ratio because it shows the company can more easily make current debt payments. Current assets refer to cash and other resources that can be converted into cash in the short-term (within 1 year or the company’s normal operating cycle, whichever is longer). In some cases, companies may attempt to improve their Current Ratio by delaying payments or accelerating the collection of accounts receivable. Analysts must be vigilant for such tactics, which can distort the true financial health of a company. Industries with predictable, recurring revenue, such as consumer goods, often have lower current ratios while cyclical industries, such as construction, have high current ratios.

- Current ratio (also known as working capital ratio) is a popular tool to evaluate short-term solvency position of a business.

- Current assets listed on a company’s balance sheet include cash, accounts receivable, inventory, and other current assets (OCA) that are expected to be liquidated or turned into cash in less than one year.

- The current ratio is a rough indicator of the degree of safety with which short-term credit may be extended to the business.

- An investor or analyst looking at this trend over time would conclude that the company’s finances are likely more stable, too.

- This suggests that a higher current ratio and quick ratio increase profitability, while a higher cash ratio decreases profitability.

If a retailer doesn’t offer credit to its customers, this can show on its balance sheet as a high payables balance relative to its receivables balance. Large retailers can also minimize their inventory volume through an efficient supply chain, which the individual shared makes their current assets shrink against current liabilities, resulting in a lower current ratio. To calculate the current ratio of a U.S. company using its balance sheet, you must first determine its current assets and current liabilities.

Because inventory levels vary widely across industries, in theory, this ratio should give us a better reading of a company’s liquidity than the current ratio. A high current ratio, on the other hand, may indicate inefficient use of assets, or a company that’s hanging on to excess cash instead of reinvesting it in growing the business. Current assets (also called short-term assets) are cash or any other asset that will be converted to cash within one year. You can find them on the balance sheet, alongside all of your business’s other assets. Here, we’ll go over how to calculate the current ratio and how it compares to some other financial ratios.

Tin Cậy Việt Công ty TNHH Tin Cậy Việt

Tin Cậy Việt Công ty TNHH Tin Cậy Việt